Bitcoin hit a record high value of 48,364 USD on Thursday following the news of Mastercard Inc. and Bank of New York Mellon Corp. introducing cryptocurrencies in their services. Big companies are embracing bitcoin is a recent phenomenon in the financial industry.

Cryptocurrency has long stayed a very secluded section in the financial industry. It had a cult following. Nonetheless, big companies stayed away from the crypto realm. However, things are changing in 2021. The covid-19 pandemic in 2020 pushed many investors into digital currencies’ arena. Investors from wall street saw bitcoin (the parent currency) as a hedge against the risk posed by inflation. Thus, the investments in BTC and other cryptocurrencies increased, causing a surge in the value of the crypto market.

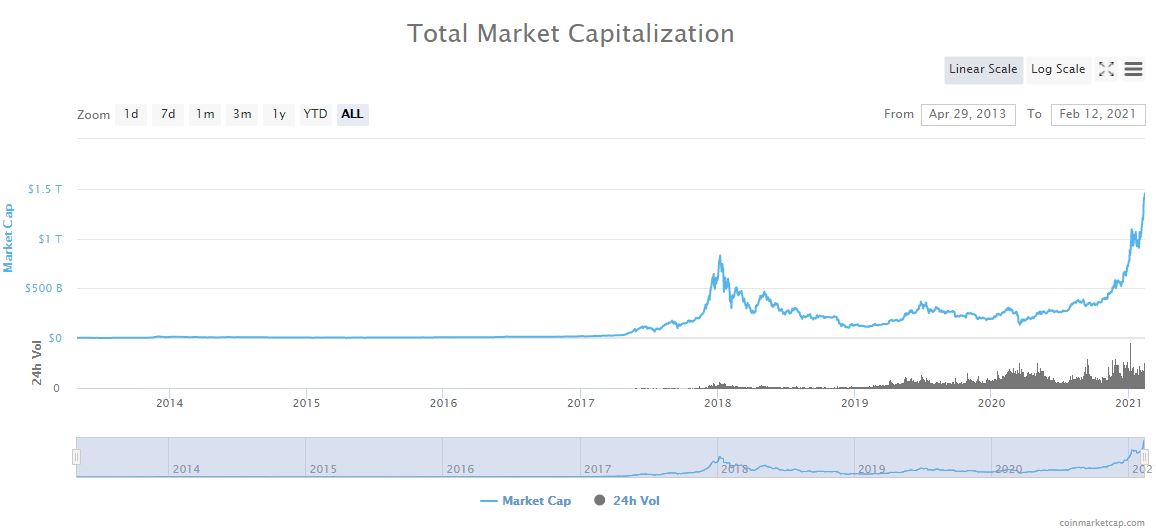

The market cap of cryptocurrencies is above 1 trillion dollars at the moment. Its following is increasing at a rapid pace. Bitcoin’s price is on the rise and hitting new highs within hours. Even the meme coins like $DOGE are having its day. Above all, big companies are embracing bitcoin.

Big Companies Embracing Bitcoin:

Mastercard is set to launch digital currencies later this year. The company is actively engaging with central banks around the world on this matter. This move of a big giant like Mastercard is bound to bring structural changes in the financial industry.

Twitter Inc. is also toying with the idea of paying its employees in bitcoin.

The proponents of bitcoin say that it was about time. They argue that bitcoin offers freedom and openness unmatched in the history of finance. It has limited supply and can’t be inflated. Thus, the future of currency is digital.

CEO of Tesla, Elon Musk, has often favored the adoption of crypto. His company has invested 1.5 billion dollars in bitcoin. Moreover, Mr Elon has, in essence, fueled the dogecoin pump through his tweets.

The detractors, on the other hand, have reservation over crypto’s future. Currencies like bitcoin have no intrinsic value. Unlike fiat, they are not pegged to any asset. Therefore, BTC can be worthless if one day everybody stopped believing in it.

Recently, the chief investment strategist at Bank of America Securities called bitcoin ‘the mother of all bubbles’.

While the discourse around bitcoin will take a long time to settle, more companies are likely to embrace bitcoin in the coming days.