Glassnode’s weekly report suggests that Bitcoin buyers are now holding as 76% of the supply of the coin became illiquid.

In the first week of 2022, the Bitcoin market is consolidating around $46K. The charts show sideways price movements. At the time of this writing, Bitcoin is trading at $46,730. However, the on-chain analytics provider Glassnode has some interesting revelation regarding BTC in circulation.

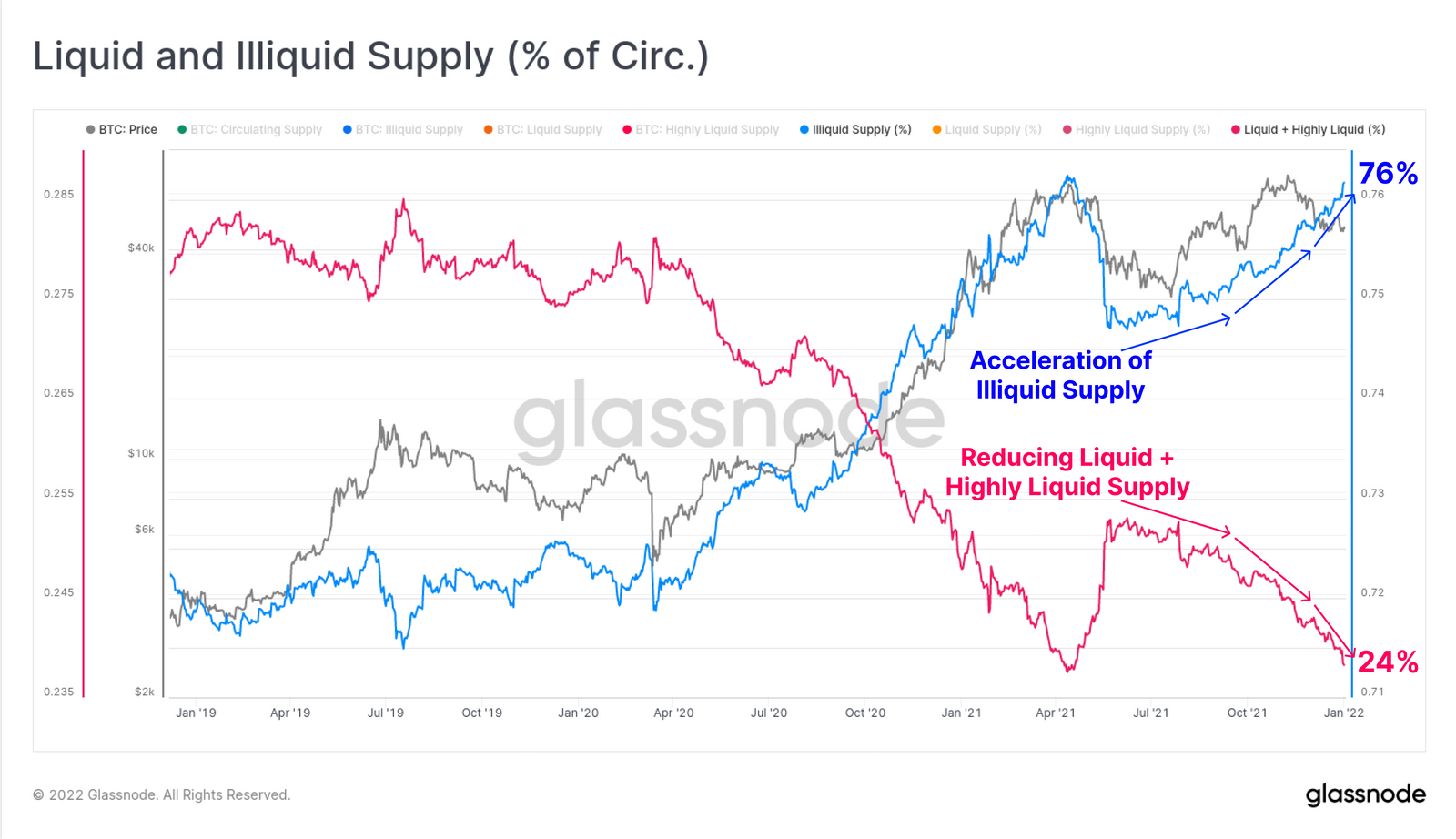

The on-chain weekly report on January 23rd found that most of the bitcoin have become illiquid. The term illiquid on Glassnode is defined as when Bitcoin go to a dormant wallet or the wallet with no prior history of trading. 76% of BTC supply is currently residing in such wallets. Whereas, 24% of bitcoin belong to the hot wallets or exchanges that trade regularly.

The illiquid supply of bitcoin has increased in the last three quarters.

We can see that over the final months of 2021, even as prices corrected, there has been an acceleration of coins from liquid, into illiquid wallets.

Here is a graph that shows the numbers in the report.

Most Bitcoin buyers are turning into long-time holders. Despite the price fluctuation and drop in price, they keep on accumulating. Therefore, the liquid supply of bitcoin has diminished.

With a bigger percentage of illiquid supply, the event of sell-off is also less likely. Hence, we will see a more solid price consolidation in the coming future.

Latest News: Attack on Solana Exchange

The long-term holders of BTC are people who have held their coins for more than 155 days. The gradual growth of hodlers suggests that belief in bitcoin is getting stronger. People are now using it as a store of value. This pits BTC against gold and other traditional assets.