Bitcoin market slides as a result of growing fear in the market. The noob traders, as always, panic sell in the face of plunging prices.

Bitcoin’s value fell off on the weekend as Elon Musk hinted that Tesla might sell its BTC. The price reached lowest level in the past 20 weeks. On Monday, Bitcoin was maintaining a support level at $42,000. This pushed noob traders to panic sell their bitcoin holdings.

According to data from Glassnode, new traders have been selling their coins at a loss. Nonetheless, those who are in the game for long are still sitting on their stash.

The adjusted Spent Output Ratio (aSOPR), which determines whether a coin was in profit or loss when it was last transferred on the chain, went under 1.0 during the dip. This depicts that on average BTC coins were sold in a loss. Most of the coins transacted in the period were less than 155-days old on the chain. It means that these coins were bought during the 2021 bull run.

Market Slide and Short Term Holders:

Bitcoin market slides further as noob traders liquidate their position. However, the old hands are not vexed and continue to buy more. Glassnode noted in its week on chain:

Overall, the Bitcoin market is in a historically significant correction. There are strong signals that short term holders are leading with panic selling, however long term holders are stepping in to buy the dip and their confidence is largely unshaken.

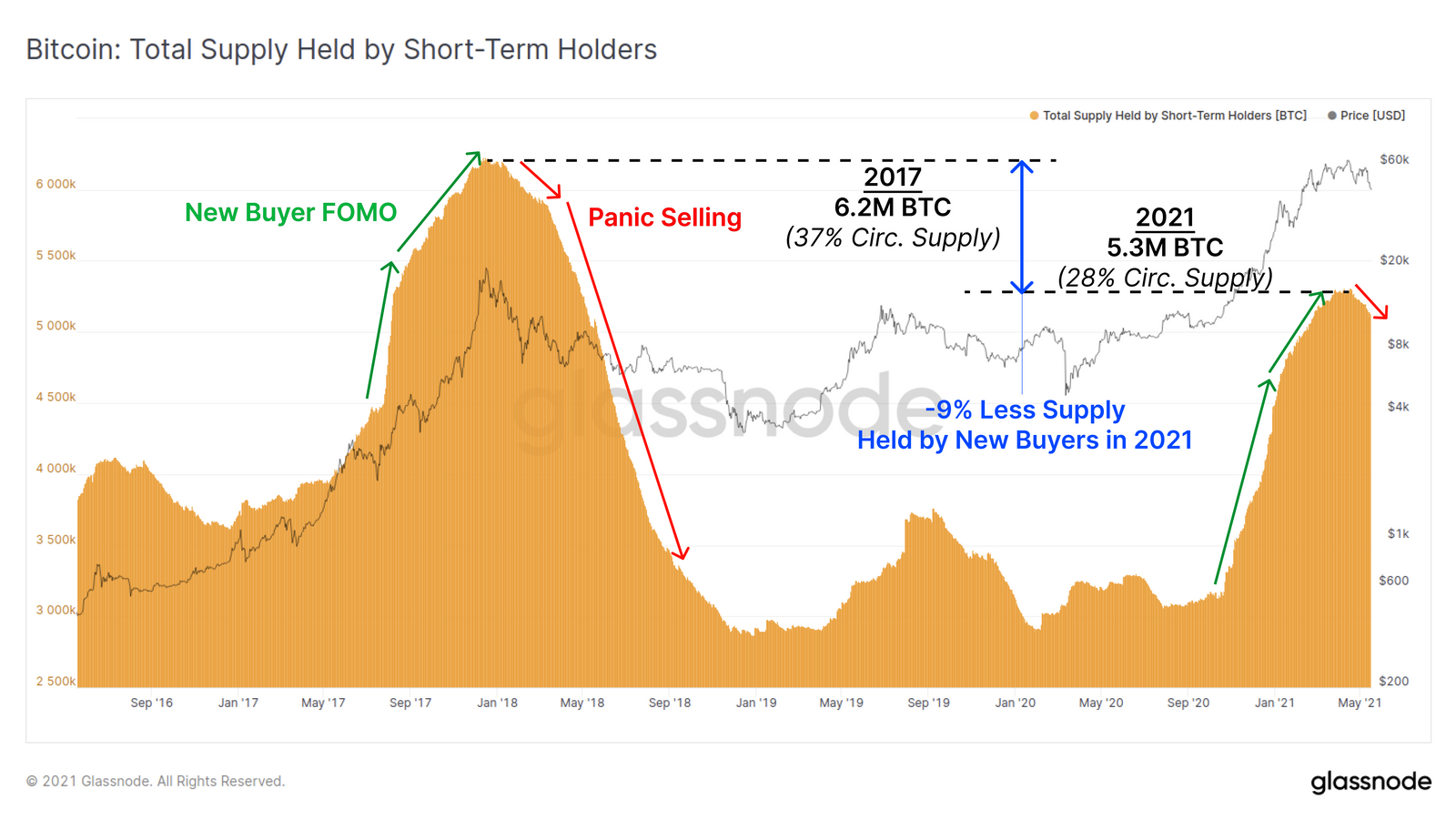

Bitcoin market slides in 2017 saw a similar pattern of panic sell. The market reach a macro peak when new buyers hold the large portion of coin supply.

The current bull run attracted many new investors to the bitcoin arena. Recently, 28% of total circulating supply of bitcoin was held by short-term holders.

2021 bull run has seen quite a few price corrections. However, last week saw the deepest correction with price slide of 28%.