Bitcoin price is pinned below $33K. However, indicators suggest BTC bull run is about to return in the coming weeks.

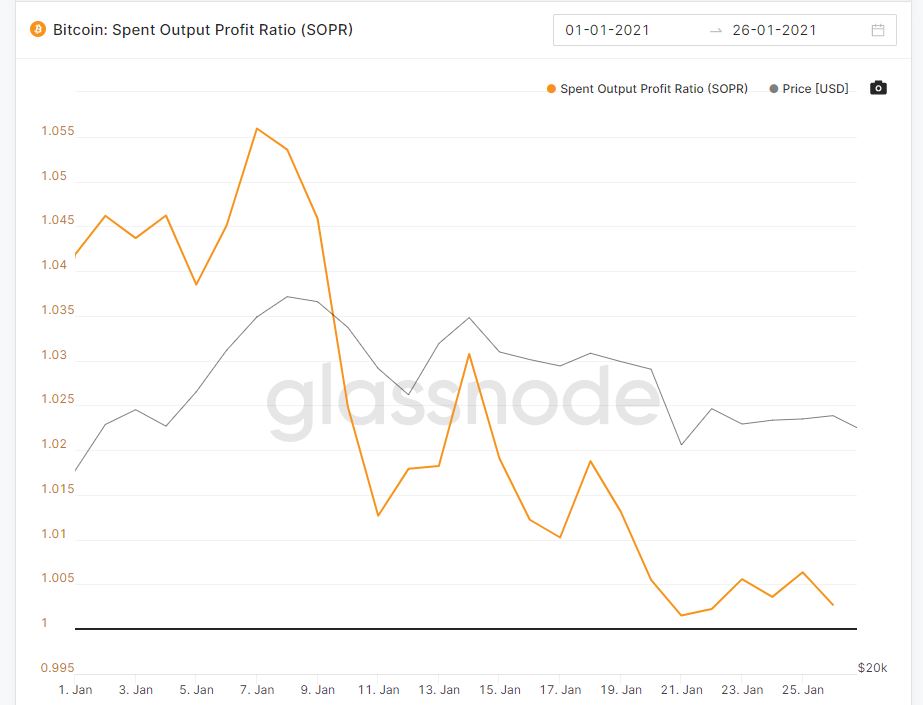

Bitcoin is having an interesting month. For the first two weeks of January, Bitcoin bull rally was on full swing. The price hit a record peak of $42K on Jan 8th. Afterwards, it kept fluctuating as price corrections were setting in. The latest analysis of bitcoin Spent Output Profit Ratio (SOPR) gives hope of price correction ending soon. This will lead to a subsequent surge. So, time for bitcoin holders to get excited. BTC bull run will return in coming weeks.

SOPR:

The data for SOPR is collected by glassnode. The basic function of SOPR is to track whether the bitcoin hodlers are selling their currencies for profit or loss. The recent report of glassnode on Monday suggested a bullish trend arriving soon.

The SOPR fluctuates around 1. When it is above 1 and plunging then the owners of bitcoin are selling their asset at different profits. Once the line at 1 is reached it is time for resetting. In other words, the BTC hodlers no longer sell their asset beyond this point stopping the downward movement of price. The report mentioned this in the following words:

In order for SOPR to go lower, investors would have to be willing to sell at a loss, which is unlikely given the current shape of the market […] We have been looking for this reset in order to generate some stability in the market and pave the way for the next bull run.

Take a look at the current chart of SOPR:

Investors are Buying the Dip:

The weekly investments in crypto products reached a record high value of $1.31 billion last week. 97% of these investments went to bitcoin. The new investors are eager to buy the dip. Hence, this factor also indicates that BTC bull run is about to return.