Coinbase listing on Nasdaq is a watershed moment for cryptocurrencies. The U.S based exchange went public on Wednesday.

The major cryptocurrencies exchange Coinbase Global Inc. is the first-ever crypto services provider to list on the United States exchange.

Not too long ago, cryptocurrencies were considered a tool for criminals. Financial analysts called crypto a bubble or a mother of bubbles ready to burst. There was no place for crypto in the mainstream financial industry. But now, here we are. Coinbase is publicly listed on Nasdaq. Trader and investors can easily buy its stock.

The direct listing has allowed existing shareholders in the exchange to sell their shares in the US stock exchange.

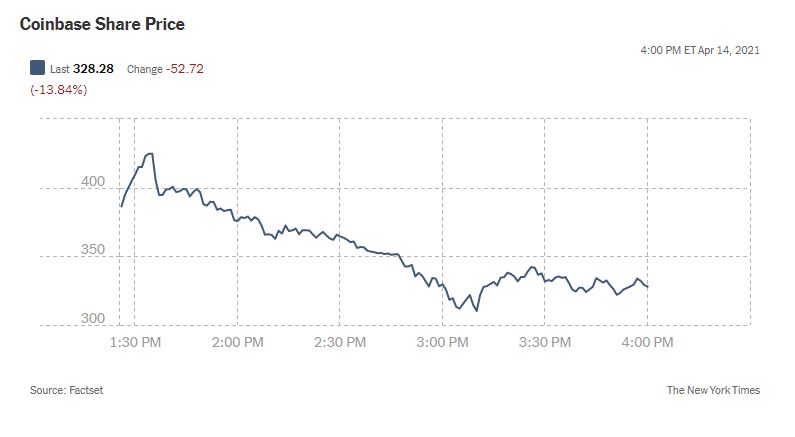

The symbol for Coinbase shares is COIN. The trading started for $381 yesterday. It went up to $429.54 before starting to plummet. At the time of this writing, Coinbase stock price is at $327.

Coinbase Listing – A Giant Leap for Cryptocurrencies

Coinbase listing is a big step in the crypto world, but it didn’t come as a surprise. Mainstreaming of cryptocurrencies has been on the go since last year. Multiple corporate investors have spent billions of dollars on bitcoin buy-ins.

The wave of crypto acceptance started in October. The online payment giant PayPal announced the plans of allowing cryptocurrency buy/sell services to its US-based customers. The company has delivered on its promise. Now US citizens can directly pay for merchandise using bitcoin through their PayPal account.

Elon Musk’s company, Tesla, also disclosed its 1.5 billion dollars investment in bitcoin. The electric car company is also allowing payment for cars in bitcoin.

The value of the crypto market has been on a meteoric rise as a result of corporate backing. The total crypto market cap has gone beyond $2 billion. Bitcoin, the parent cryptocurrency, smashed the all-time high price record on Wednesday and reached $64K.

Investors can now buy stocks of Coinbase and take advantage of the crypto market’s movements without actually buying the coins.