A Reddit group, by the name of wallstreetbets, made the stock price of GameStop go up by 700% within a week. This resulted in a loss for hedge funds and short-sellers on wall street.

GameStop is an American seller of videogames, electronic consoles and other collectables. The company has 5000+ shops around the country. There was nothing fancy about GameStop up until yesterday when all of a sudden its stock price skyrocketed.

Gamestop Mania:

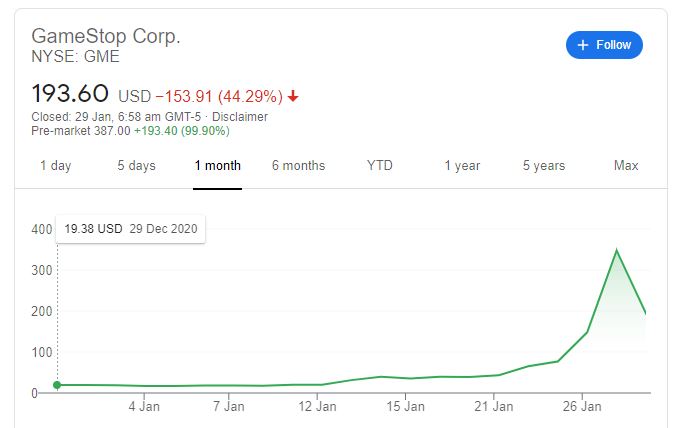

Gamestop’s business wasn’t performing well for some time. Its stock price of the GameStop was close to $19 on January 1st. People on wall street were short-selling the stocks of GameStop.

Short-selling is when you borrow the stocks which you know will go down in value. You then sell those stocks. When the price actually goes down, you buy them back and return to the lender while profiting from the price difference. It is kind of a bet.

Let’s take a simpler example. You borrow a cup from your friend John with the promise of returning it. The price of the cup is $5. But, you are sure that its price will go down in future. Now, you go to the market and sell the cup for $5. After two days you hear that price of that cup is $3. So you go and purchase it for $3 and return to your friend John. You just made a $2 profit.

In the same way, loads of GameStop stocks were being borrowed and sold in wall street. The investors were hoping that the price would go down but the opposite happened.

Source: Google

People in the Reddit group wallstreetbets started buying GameStop’s stocks driving the price up. The short-sellers, fearful of losing money, started buying back and the whole frenzy led to an increase of GameStop’s stock price by 700% within one week.

Power of the Internet:

This event was a reminder that the discourse on the internet can bring massive changes in the actual world. A bunch of people from social platforms like Reddit brought wall street to its knees. No wonder wall street has pushed back by halting the buying of GameStop shares on multiple trading platforms including Robinhood.

People on the internet are calling it a generational fight. Many, including CEO of tesla, were critical of short selling.

u can’t sell houses u don’t own

u can’t sell cars u don’t own

but

u *can* sell stock u don’t own!?

this is bs – shorting is a scam

legal only for vestigial reasons

wrote Elon Musk on Twitter.

Dogecoin followed the same route as Gamestop yesterday with a price surge of 80% within a few hours.